Because of this, the MFI tends to act a bit differently with the RSI because volume leads prices. While we have been in the trading business for many years and use https://forexhero.info/software-engineer-vs-programmer/ these indicators often, we don’t know how most of them are calculated. As we have written before, you don’t need to know how these indicators are calculated.

Apple’s shares soar to a new high and closer to a $3 trillion market cap as Big Tech takes off again – Fortune

Apple’s shares soar to a new high and closer to a $3 trillion market cap as Big Tech takes off again.

Posted: Mon, 12 Jun 2023 21:19:00 GMT [source]

That’s why in today’s guide, I’ll dive into the Money Flow Index so you can trade trend continuations and trend reversals like a pro. The typical price for each day is the average of high price, the low price and the closing price. The money flow index (MFI) is an oscillator that ranges from 0 to 100. It is used to show the money flow (an approximation of the dollar value of a day’s trading) over several days. Traders also watch for larger divergences using multiple waves in the price and MFI. For example, a stock peaks at $10, pulls back to $8, and then rallies to $12.

Market Indexes

The best way to think of the MFI is to consider the RSI, which we covered before. Basically, Gene and Avrum understood the importance of volume and how it affects the markets. You will find the indicator in all trading platforms like the MT4 and our PPro8.

A look at Solana’s state as its price action continues to disappoint – AMBCrypto News

A look at Solana’s state as its price action continues to disappoint.

Posted: Thu, 08 Jun 2023 20:33:17 GMT [source]

It can also be used to spot divergences which warn of a trend change in price. The similarities with the relative strength index don’t end in the calculation methods. MFI is also a momentum indicator that helps to identify the upcoming pullback or trend change in an asset.

Using the MFI to find divergence

The main difference from the RSI is that the MFI uses volumes as a part of calculations, which can be quite helpful as volumes provide a better outlook on the market sentiment. Generally, the MFI is a mid-term instrument that works best on the H4 and higher timeframes, but skilled traders may use it for short-term trades as well. It occurs when the price changes to a new low, whereas the MFI, indicates a higher low showing a boost in money flow.

- As a part of our market risk management, we may take the opposite side of your trade.

- So, depending on what you think will happen with the asset’s price when one of the signals appears, you can open a long position or a short position.

- Security will be considered overbought if the MFI shows a fast price rise to a high level.

- The only distinction between this indicator and the Relative Strength Index is that it includes volume in addition to price in its computation.

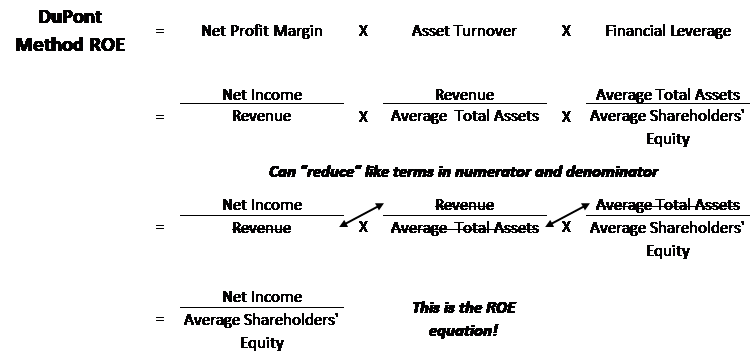

The index is usually positive when the price is rising and negative when the price is falling. The money Flow Index indicates the percentage of positive money flow compared to the total money flow. When the current typical price is higher than the previous one, it is considered positive money flow, and vice versa. If the current typical price is larger than the preceding typical price, then the money flow is positive, and vice versa. A technical signal called the Money Flow Index, or MFI Signal, shows how much money is coming into and going out of an asset over a predetermined period. This advantage is that traders can quickly determine when the demand for an asset rises or falls based on the movement of money.

Trading Commissions

If today’s typical price is larger than yesterday’s TP, then the money flow is considered positive. If today’s typical price is lower than that of yesterday, the money flow is considered negative. MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices. MFI values above 80 are considered overbought, indicating that prices could pull back. MFI values below 20 are considered oversold and may indicate a potential rebound. Positive money flow is equal to the typical price for the period multiplied by the volume for the period.

The MFI can help confirm trends and reversals when used with other indicators. A bearish divergence occurs when the MFI forms lower highs while price action forms higher highs. This indicates that buying pressure is weakening, and a reversal to the downside may be imminent. There are four steps in failure swings in both types of failure swings — bullish and bearish. Technical analysis focuses on market action — specifically, volume and price. When considering which stocks to buy or sell, you should use the approach that you’re most comfortable with.

MFI vs. other momentum indicators

The simplest way is to wait for the MFI to slide below 20 and indicate the end of the selling activity. The stock went even lower later, but it’s unimportant because we still had a profitable and reliable trade. It would be best if we took the whole movement, but we should be happy with what we got. The MFI is an oscillator; we should read it like every other similar indicator. Readings above the 80 level represent an overbought zone and signal about possible downside reversal.

What is the difference between on balance volume and money flow index?

The OBV And The Money Flow Index (MFI)

The difference between both indicators is that the MFI pays more attention to price action. The OBV uses price action as absolute criteria. The volume of periods with rising prices is added to the calculation, the volume of periods with falling prices is subtracted.

The money flow index calculates the ratio of positive and negative money flow over a period of time. The formula for calculating the money flow index involves several steps. Most platforms like FOREX.com will calculate the MFI automatically, but it can be useful to understand how it’s done. Most platforms like City Index will calculate the MFI automatically, but it can be useful to understand how it’s done. The money flow index (MFI) is a volume-weighted oscillator that helps gauge overbought and oversold markets.

How can you use Money Flow Index in trading

For starters, the Relative Strength Index (RSI) is a technical indicator that is classified as an oscillator. It basically measures the speed of change of a financial asset and helps to identify overbought and oversold levels. We think the divergence trading strategy is one of the best for the money flow index.

A divergence is when the oscillator is moving in the opposite direction of price. This is a signal of a potential reversal in the prevailing price trend. Divergences refer to points where an asset’s price is rising while the indicator is falling and vice versa. Identifying a divergent period early enough can help you see when a reversal is about to happen.

What is MFI in polymer?

1 Melt Flow Index. The melt flow index (MFI) is a measure of the ease of flow of the melt of a thermoplastic polymer. It is defined as the weight of polymer in grams flowing in 10 min through a die of specific diameter and length by a pressure applied by a given weight at a given temperature.